[ad_1]

Join Fox News to access this content

Plus, use your account to get special access to selected articles and other premium content – free.

By entering your email to continue, you agree to Fox News Terms of Use and Privacy Policy. This includes notifications of financial incentives.

Please enter a valid email address.

Are there any problems? click here.

Newou can listen to Fox News articles!

This is cobblestones together from various sources, and there is a timeline of how the Senate will try to pass President Trump’s “big beautiful bill” this weekend, and the House will try to match next week.

Fox is said to not be able to vote procedurally until Friday for the Senate to formally reach the bill. That would require 20 hours of discussion/clock time to be carried out in the Senate after they reach the bill. Procedural voting requires only a simple majority.

20 hours of discussion/clock are divided. The Democrats will probably burn all 10 hours. Republicans use some. So the Senate will likely begin “voting” on the bill late on Friday night or early on Saturday morning.

Reporter’s Notes: Who will really decide when America will go to war? The answer is not that clear

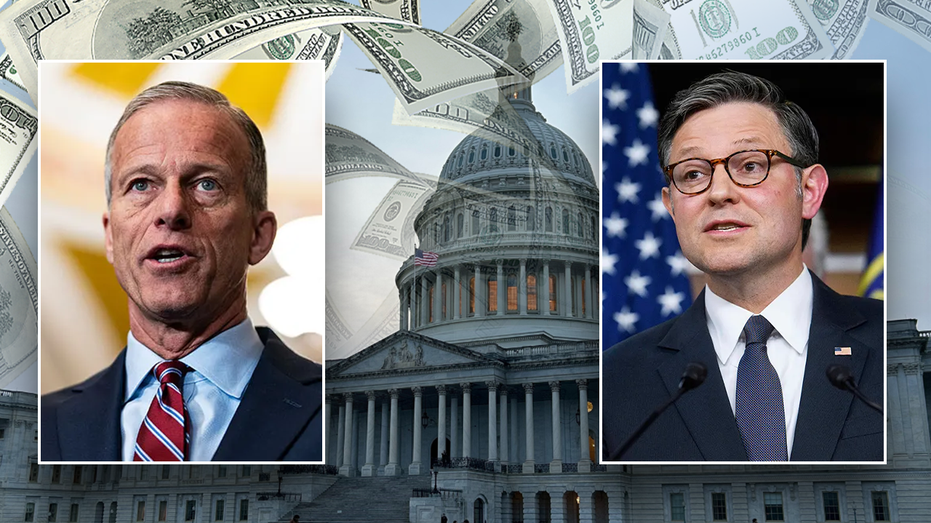

Fox is said to not be able to vote procedurally until Friday for the Senate to formally reach the bill. (Getty Images)

“Rama’s Voting” is where the Senate takes hours to voting consecutive roll-call votes on a package.

The Senate began this long voting sequence late on Friday (meaning just after midnight) and could last until late Saturday, if not early on Sunday.

It will peak with the passage of the bill in the Senate late Saturday or early Sunday.

The Senate GOP aims to approve next week’s major law to promote party unity

Senate Majority Leader John Tone (Getty Images)

It’s not that it’s impossible to know when this will happen. But frankly, the final vote could come anytime, day or night, throughout the weekend, unless it was early Monday.

The latest voting llama took place in just under 10 hours. The 2021 voting llama spent 14 hours and 48 minutes, with the Senate considering a total of 40 amendments.

We believe this llama’s vote may be on the longer end.

The question is D-Va by Senator Tim Kane. It is whether the resolution of the war’s authority by delaying the start of votes and reaching “big beautiful bills.” Kane’s resolution may not arrive until Friday.

Here are the other wildcards:

How quickly can the House pivot to pass the bill and align it with the Senate?

Trump’s “big, beautiful bill” was sent to the Senate after the House voted to pass it. (AP; Getty; Fox News Digital)

If the Senate oks the bill on Saturday or Sunday, there’s one scenario where the House of Representatives is trying to move very quickly, and we’ll close it down later on Sunday or Monday morning. They don’t want members to sit without doing it.

They also need to point out the “72-hour rule” to allow the House to read the bill before the votes apply. The Senate is sending “amendments” back to the House of Representatives plans. Therefore, the “72-hour rule” is not counted in these situations.

But R-La. House Speaker Mike Johnson could face political pressure to let members consider the bill for a day or two. It could delay the passing of your home until Tuesday or Wednesday.

House Speaker Mike Johnson speaks to the media after narrowly passing a bill forwarding US Congressional legislation in Washington on May 22, 2025. (Kevin Dietsch/Getty Images)

But this is all about whether things are swimming or not. Many unresolved issues remain. So it can push back the passages of both body.

Fox is said to be the biggest hold-up in the entire process trying to massage the number of spending/expenditure cuts.

When asked what the most complicated issue was, Fox was told it was a reduction in salt, state and local taxes in high taxes.

Click here to get the Fox News app

Fox is said to be that the Senate may try to go to the “40,000” home level for a deduction. But what’s important is when the Senate removes its income cap to take advantage of that tax credit. In other words, the Senate may try to put the ceiling in an amount that taxpayers can earn before qualifying for a salt break.

However, members of the Salt Caucus show that it is unacceptable. They want a straight deduction of $40,000. Currently, the Senate bill has a $10,000 deduction. This is a non-starter for Republicans in New York and California who are seeking substantial salt deductions.

[ad_2]Source link