[ad_1]

First on Fox: Republican lawmakers are making massive efforts to abolish the federal inheritance tax, known as the “death tax.”

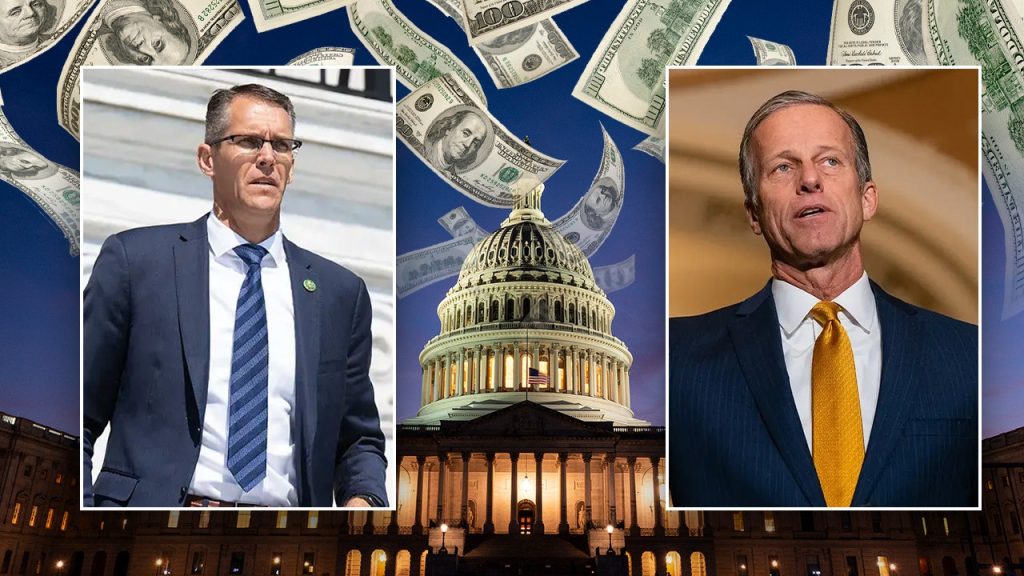

R-Iowa’s Rep. Randy Feenstra leads more than 170 House Republicans in the Death Tax Abolition Act, backed by House top tax writer Jason Smith, Speaker of Ways & Means, and R-Mo.

Inheritance or real estate taxes are levied on beneficiaries who receive the assets upon the death of a person. Republicans have long criticized the estate tax, particularly as an unnecessary financial burden on families of grieving that have hit small family-owned businesses.

Republicans are working to expand President Donald Trump’s 2017 tax cuts and employment laws, and that provision expires at the end of this year. Among the 2026 sunset measures, real estate tax exemptions have doubled.

Scoop: Major Conservative Caucus Draws Red Lines in House Budget Plans

Rep. Randy Fencestra and Senate Majority Leader John Tune is leading new efforts to eliminate federal property taxes (Getty Images).

Federal property tax advocates point out that it affects relatively few properties. According to the latest IRS data, penalties are triggered for property worth around $13.9 million at the time of death.

The Senate counterpart bill is led by majority leader John Tune (Rs.D.) and is supported by 44 senators.

Both Fentra and Tune argued that it was unnecessary taxes that had an unfair impact on their hometowns, such as Iowa and South Dakota.

Black Caucus Chairs accused Trump of “purge” of “minority” federal workers

Comes as Republicans work to expand President Trump’s 2017 tax cut (AP/Alex Brandon)

“The death tax is such a terrible double tax that it unfairly targets family farms and small businesses in America and directly threatens long-standing agricultural traditions across the country and across the country,” Fehenstra told Fox News Digital. Ta. “It’s ridiculous for the federal government to send massive tax bills to grieving families when a loved one dies.”

He said it amounted to “double taxation.”

“Family farms and ranches play an important role in our economy and are the lifeblood of rural communities in South Dakota,” Thune told Fox News Digital.

“It’s too much to lose even one of them’s death tax. Now is the time to make this punishment, to ensure that ranches, small and medium-sized businesses can grow and flourish with costly real estate plans and large businesses. It’s time to put an end to this punishment and burdensome tax. Tax burdens that could threaten the viability of the tax.”

Click here to get the Fox News app

If Republicans fail to extend Trump’s tax cuts by the end of this year, real estate taxes will affect properties worth around $7 million or more, according to modern wealth laws.

Republicans on the House Ways & Means Committee shared a note late last year. This said that if the tax cuts expire, American households can see their taxes rise by more than 20% each day.

However, the Feenstra and Thune bills would completely eliminate taxes.

Elizabeth Elkind is the main reporter of Fox News Digital’s reporting in the House of Representatives. Previous digital bylines seen on Daily Mail and CBS News.

Follow me on Twitter at @liz_elkind and send tips to Elizabeth.elkind@fox.com

[ad_2]Source link