[ad_1]

First Fox: Republican lawmakers are pushing for stopping the state from imposing gun taxes on guns and ammunition sales, accusations of the California measure that came into effect in 2024.

In 2023, California became the first state to adopt an excise tax measure targeting the gun industry. The law sets an 11% excise tax on guns and ammunition sales, and directs revenues towards gun abandonment programs and other gun control initiatives.

Colorado is poised to impose a 6.5% excise tax on similar purchases in April. Other states, such as Maryland, New York and Massachusetts, are considering similar laws.

NRA legislative experts say gun rights can see “most monumental” victory in Congress since 2005

However, Republican lawmakers say these initiatives amount to unconstitutional taxes that undermine the second amendment.

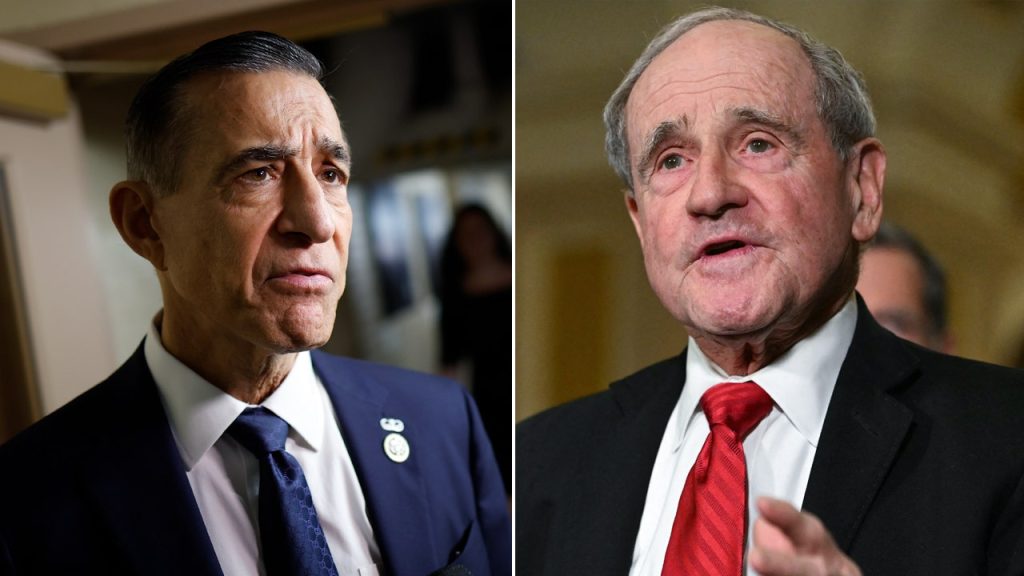

Senator Jim Risch of R-Idaho and Rep. Darrell Issa of R-Calif introduced unfair gun tax laws in their respective assembly rooms on Thursday, but banned the adoption of these measures.

Republican Sen. Jim Riche introduced unfair gun tax laws in the Senate on March 27, 2025 (Al Drago/Pool/Getty Images)

“Blue has said it is implementing excessive excise taxes to fund gun control initiatives,” Riche said Thursday in a statement to Fox News Digital. “Freedom from unfair gun tax laws ensures that states do not place a significant financial burden on law-abiding gun owners to advance their agenda of the secondary amendment agenda.”

Issa said states like California historically introduced “extreme” policies targeting gun owners, putting their second amendment rights at risk.

The Supreme Court supports Biden Administrator’s “ghost gun” regulations

“The latest attack is the imposition of a ‘sin tax’ on California firearms and ammunition,” Issa said in a statement in Fox News Digital.

Specifically, Isa argued for a new California law, requiring gun sellers to create excise tax bills, claiming it was an “outrageous unfair burden on law-abiding citizens.”

Excise tax covers certain goods or services intended for manufacturers, consumers, or retailers. The new excise tax in California, coupled with the 10% to 11% federal excise tax gundates spent on wildlife conservation efforts, is already paid.

Rep. Darrell Issa led the introduction of a law prohibiting excise taxes on state guns and ammunition. (Stefannie Keith/Bloomberg via Getty Images)

California State Sen. Jesse Gabriel is a Democrat representing the San Fernando Valley and enacted a law known as the Gun Violence Prevention and School Safety Act in 2023, imposing a sales tax to raise revenue to support programs, including California’s Violence Intervention Prevention Program.

The law also allocates revenue from excise taxes to court-based gun waiver programs revoking gun ownership from domestic abusers and convicted offenders and law enforcement initiatives focusing on gun investigations.

California Governor Gavin Newsom signed the law in September 2023 and came into effect in July.

Click here to get the Fox News app

California Governor Gavin Newsom signed a California bill in 2023 targeting gun purchases to the law (Jose Lewis Vilgas/Act. Published by:

“It’s shameful that gun manufacturers are simultaneously reaping gun violence that has become a major cause of death for children in the United States,” Gabriel said in a July statement. “The law generates $160 million a year to fund critical violence prevention and school safety programs that save lives and protect communities across California.”

Co-sponsors for the Senate’s Unfair Gun Tax Free Edition include Republican Senators of South Carolina, Deb Fisher of Nebraska, Mike Crapo of Idaho, Marsha Blackburn of Tennessee, Bill Cassidy of Louisiana, Kevin Klemer of North Dakota, Cindy Hyde Smith of Mississippi, Jim Justice of West Virginia, and Pete Ricketts of Nebraska.

North Carolina Republican representative Richard Hudson and California’s Doug Lamalfa also co-hosted the House version of the measure.

Diana Stancy is a political reporter for Fox News Digital, covering the White House.

[ad_2]Source link