[ad_1]

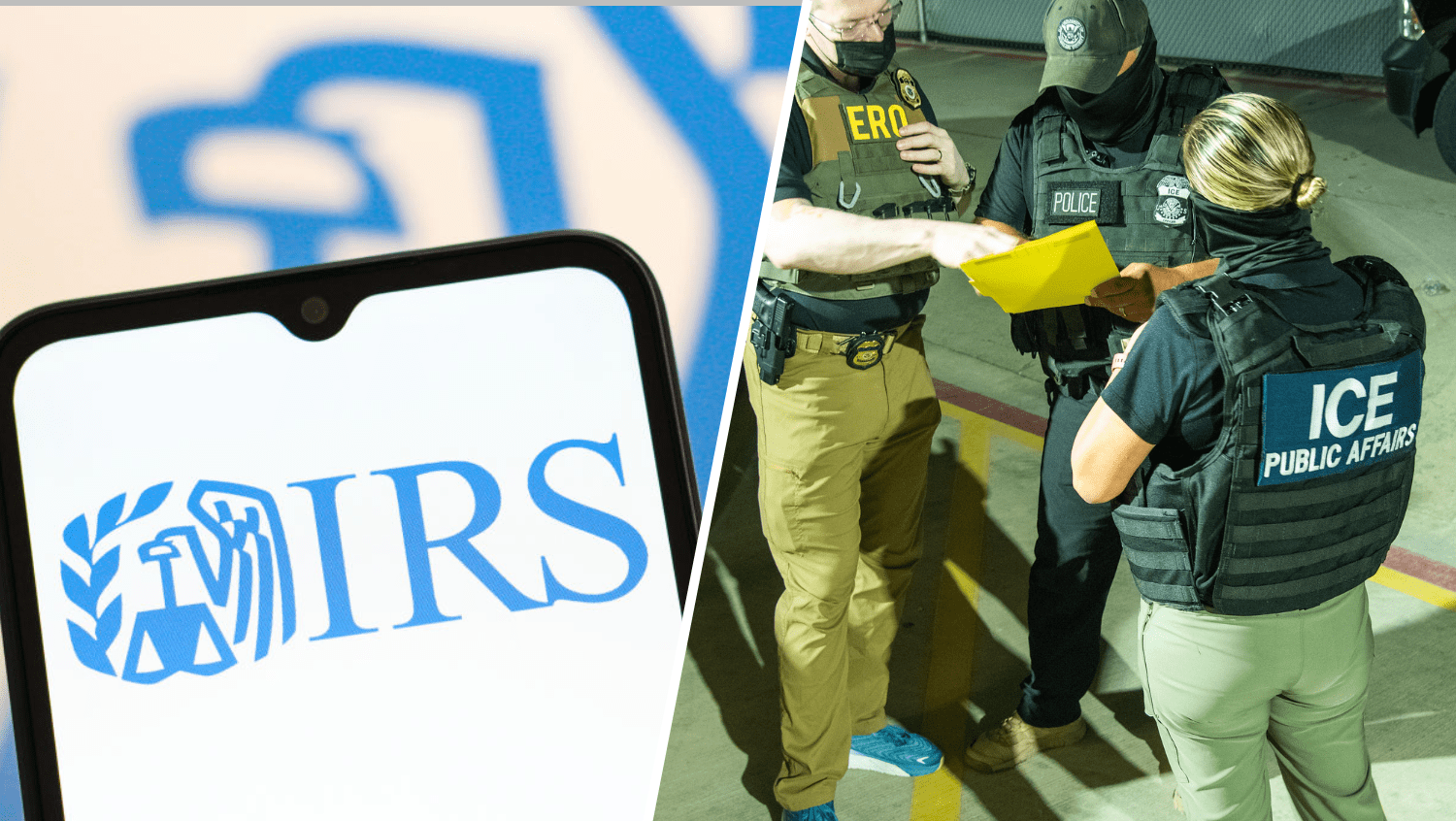

Although it’s not a completed transaction yet, if the contract is broken between the Internal Revenue Service and US immigration and customs enforcement, immigration advocates and lawyers say it’s the first time the government has used a confidential taxpayer database to help with vast cleaning facilities.

“Many people are scared and probably trying to stop paying taxes,” said Alma Rosa Nieto, an immigration lawyer in Los Angeles. “It’s a double edge sword.”

Undocumented immigrants have paid taxes for decades in the hope that their commitment to serving the country could impact immigration reform and the path to citizenship.

In 2022, undocumented immigrants paid $96 billion in taxes, according to the Institute for Taxation and Economic Policy.

“Of course, if the theme is massive deportation, this is another long arm to find more people,” Nieto said.

The Washington Post reports that the IRS has finalized an agreement with the Department of Homeland Security. ICE can cross-reference undocumented immigrants who have an IRS confidential taxpayer database and “final removal orders.”

Only the Secretary of Homeland Security and the acting Ice Director are authorized to file requests with the IRS.

“I’m not afraid,” said Juan Mateo, an undocumented immigrant who said he’s been living in the US for 25 years and filed taxes every year. “He has nothing to hide, and there is nothing to fear.”

Mateo believes he’s fine as he has no deportation order or criminal history.

Many undocumented immigrants file their taxes using the individual taxpayer identification number or itinin. It’s like a taxpayer’s Social Security number.

A Trump-appointed federal judge rejected the recent emergency control order halting the contract citing the declaration of the IRS Chief Privacy Order that “the tax return information discussed in the complaint has not been disclosed to DHS,” saying “Neither President Trump nor the White House have requested tax return information for immigration purposes.”

[ad_2]Source link