[ad_1]

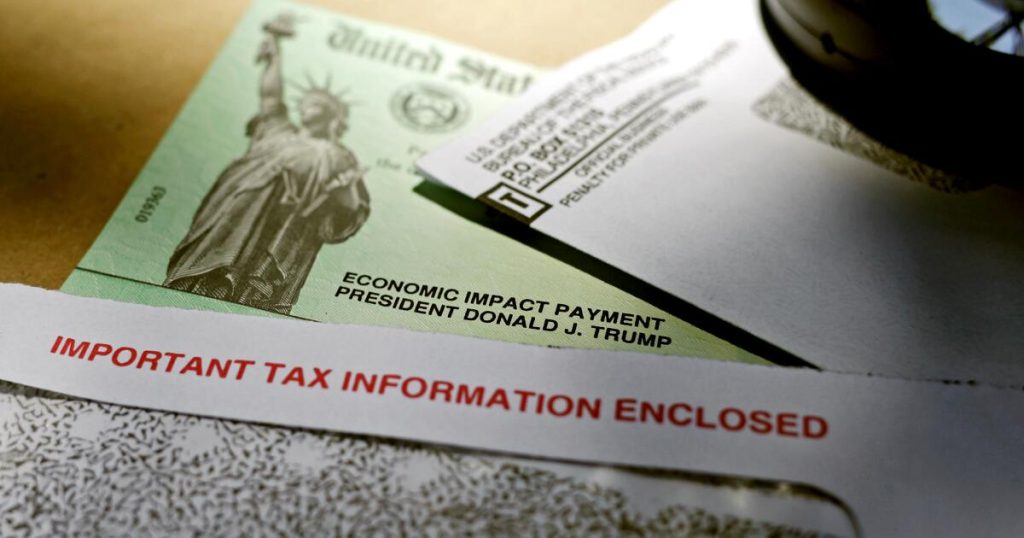

The Internal Revenue Service, everyone’s favorite Christmas gift giver, is distributing more than $2 billion in checks to Americans this month as part of its efforts to ensure everyone receives stimulus payments starting in 2021. announced that it would be paid.

The Federal Tax Service announced that an internal investigation found that many Americans did not receive economic impact benefits that were supposed to be paid after they filed their 2021 tax returns. Because of this, government agencies are still paying money owed to Americans who didn’t receive their checks.

While most eligible Americans received their stimulus payments, checks will be sent to those who qualify but filed their 2021 tax returns with the Recovery Rebate Credit field left blank.

These people will receive up to $1,400 in benefits from the federal government. Payments are expected to be received by late January 2025 at the latest.

“These payments are an example of our commitment to going the extra mile for taxpayers. A review of our internal data shows that 1 million taxpayers are actually eligible However, we now know that this complex deduction was overlooked,” said IRS Commissioner Danny Wuerffel. “To minimize headaches and get this money to eligible taxpayers, we are automating these payments, meaning these people must file an amended return to receive it. There is no need to go through the extensive process of

Americans received $1,400 stimulus payments as part of the $1.9 trillion COVID-19 relief bill. Millions of Americans were eligible for payments.

To get the check, Americans needed to earn less than $75,000 a year, or less than $150,000 as a household.

[ad_2]Source link