[ad_1]

Newou can listen to Fox News articles!

First on FOX: Senate majority leader John Tune weathers headwinds at his own meeting about notable concerns about President Donald Trump’s “big beautiful bill” threatening to derail the law, but he’s roaming about reaching the president’s desk by July 4th.

“We have to hit it. We know if that means it’s the end of next week or it’s going to roll in the week of July 4th,” the South Dakota Republican told Fox News Digital in an interview from the Leadership Suite.

“But if we have to go that week, we will,” he continued. “I think that’s so important, and you know what I’ve seen around here. At least in the past, my experience tends to be endlessly dragged, if there’s no deadline.”

Top Trump Allies predict that the Senate will blow past the deadline for “big, beautiful bills”

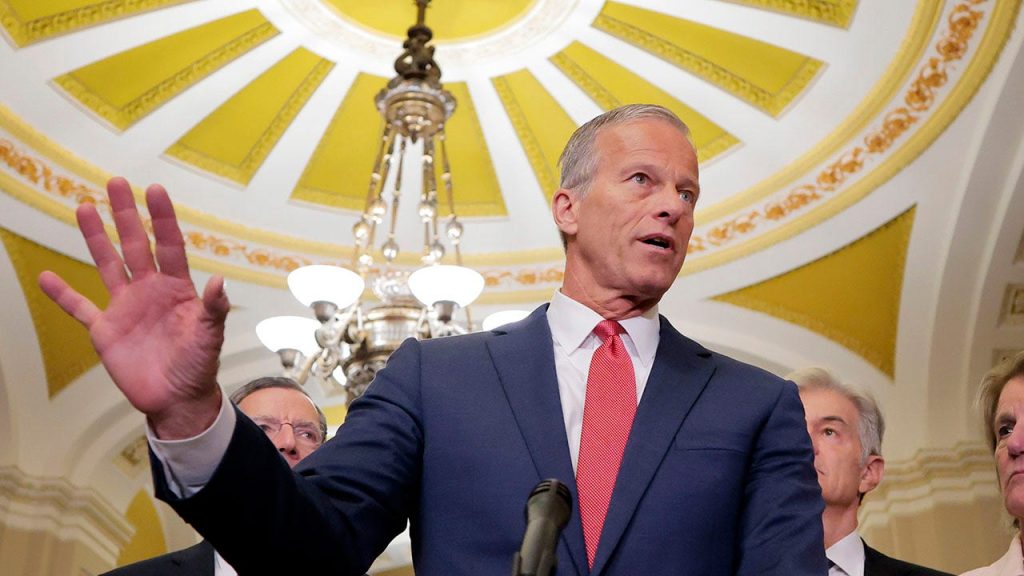

Senate Majority Leader John Tune will speak at a press conference at the U.S. Capitol on June 17, 2025 (Getty Images)

Senate Republicans have been working on a version of Trump’s mammoth bill, which includes priorities for permanent action on tax cuts and employment in 2017.

With each part of the bill being announced, Thune is looking to have the bill on the floor by mid-next week. However, he still needs to narrow down different factions within the Senate GOP to get on the bill.

“It’s a work in progress,” Thune said. “You know, sometimes it’s kind of a progressive baby step.”

R-Wis. The cohort of fiscal Hawks led by Sen. Ron Johnson is unhappy with the bill’s level of spending cuts. Some Senate Republicans want to achieve at least $2 trillion in spending cuts over the next decade, but Johnson believes the bill should get deeper and return to pre-19 pandemic spending levels.

Officer Susan Collins, R-Maine, Josh Hawley, R-mo. , and others, including Lisa Markowski of R-Alaska, are upset by Medicaid tweaks, and the impact that these changes have on the benefits of rural hospitals and healthcare programs.

“It just baffles me”: Senate Republicans warn about changes in Medicaid and spending in Trump’s megaville

Senate Majority Leader John Tune shows that there is a high chance that changes will occur in the House version of President Trump’s “big, beautiful bill.” (Getty Images)

Thune must do a volatile balance act to protect his meeting concerns, given that he can only afford to lose three votes. That’s the reality he admits and explains he’s trying to find a “sweet spot” and allows the bill to be brought back home.

He meets factions individually, communicates with the White House, and works to “make sure everyone is rolling in the same direction.”

“Everyone has a variety of views on how to do it, but in the end they put together the 51 votes that they need, so they work with the people who are providing feedback,” he said.

Collins and others are working on their sides to establish a provider relief fund that can provide ointment on the bill’s lingering issues regarding the Medicaid provider tax repression.

The Senate Treasury Committee includes a provision that freezes the House provider tax rate, or state Medicaid programs that pay healthcare providers on behalf of Medicaid beneficiaries, are even further than what they pay to healthcare providers on the expanded state of the Affordable Care Act, lowering the tax rates in the expanded state each year until it reaches 3.5%.

“We’ll do everything we can to make sure that rural hospitals, for example, have received additional support to make that transition smoother,” Thune said.

Blue Republicans threaten Trump’s “big and beautiful bill” rebellion if the Senate changes key tax rules

At the end of the Marathon Voting Series in the Senate, an revised version of the House Past Lamp budget was voted. (Reuters)

Thune, a member of the Finance Committee, said, “I agreed that the provider tax was gamed and pointed out that it was “abused” by blue states like New York and California, and claimed changes were made to help the program “on the ship.”

“That’s why I think it’s like a soft landing approach with off-ramps. [from] The Finance Committee makes sense, but these are major changes. But on the other hand, if we don’t start a few things to reform and strengthen these programs, then these programs won’t last forever.

However, Senate products are not the end of the settlement process. Changes to the bill must be lit green by the House, with one change, particularly the state and local tax (salt) deduction caps, already infuriating a cohort of Republicans at Blue State House, threatening to kill the bill.

For now, the Senate bill has left a $10,000 cap on policies led by Trump’s first term tax cuts.

Certainly, Sen. Markwayne Mullin of R-Okla has worked with members of the Salt Coucus home to find a compromise for Cap. However, the Senate does not have a strong appetite to maintain the $40,000 House Pass cap.

“My passion for the Senate is as strong as the House of Representatives opposes changing current policies and laws… supporting a high tax state with the disadvantages and disadvantages of a low tax state,” he said. “And that’s the sentiment you’re seeing on the House side about that particular issue, and it’s in a different direction in the Senate.”

Meanwhile, as negotiations continue behind the scenes between Senate Republicans on how to deal with the issue, Senate members are now plaguing each section of the larger “big beautiful bill.”

The role of Parliament is to determine whether policies within each section of the bill will fit the Byrd rule, a mysterious set of parameters governing the budget adjustment process.

Thune has regained his position once more by revealing that he will not overturn that Congressman in Trump’s Megaville. The settlement process gives either party power, gives the opportunity to pass laws on the party line and skirt the Senate filibuster, but requires compliance with the Bird Rule requirements that the policy deals with spending and income.

Click here to get the Fox News app

However, he countered that Senate Republicans planned to take the page of Senate Minority Leader Chuck Schumer, DN.Y. when Democrats plunged into former President Joe Biden’s agenda through Congress.

“The Democrats [Inflation Reduction Act] and [American Rescue Plan Act]in that respect, they dramatically expanded the scope of the settlement and eligibility for consideration,” he said.

“So we used that template. We are pushing as hard as we can to enable us to achieve our agenda, or at least as many agendas as possible, and to fit the parameters of what is permitted,” he continued.

Alex Miller is a writer for Fox News Digital, which covers the US Senate.

[ad_2]Source link